Backpacker Job Board readers can signup today with CurrencyFair and get three free transfers!

Transferring Money Overseas Using CurrencyFair

CurrencyFair is a peer-to-peer international money transfer system that promises to provide the most competitive exchange rates on the market. While not the only peer-to-peer currency exchange service out there, CurrencyFair is one of the most widely used. While more competitors are emerging online rivalling CurrencyFair, it remains the market leader.

CurrencyFair Overview

CurrencyFair was founded in 2010 by expats who were struggling to make their finances cover their expenses when living abroad. They found that the combination of a huge transaction fee and unfavourable exchange rates meant that when transferring their money from one country to another, they were losing a lot of money. The idea was formed to create a new way to transfer money overseas that is favourable for expats and backpackers. Because of this, CurrencyFair has some of the lowest transaction fees and promises a mid-market exchange rate. In some cases, you can even find a more favorable exchange rate through CurrencyFair. Since its establishment, users from across the world have transferred more than €6 billion and saved a combined €200 million in fees.

How It Works

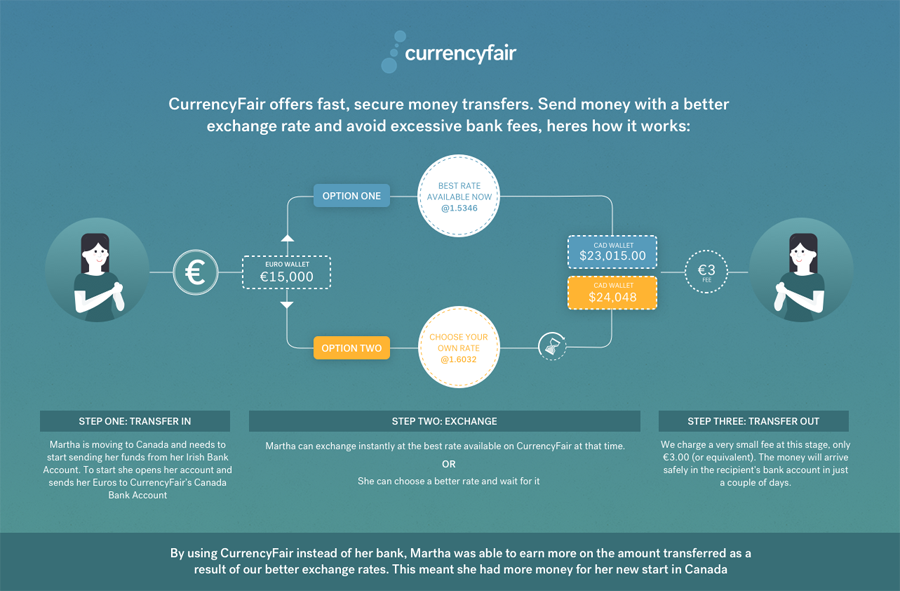

Unlike traditional international bank transfers, when you use CurrencyFair to convert currencies, no money is ever actually transferred overseas. Instead, your currency is effectively ‘sold’ to other customers in different countries. So, for example, if you were looking to transfer Great British Pounds (GBP) into Euros, you would put your selected amount of pounds ‘for sale’ at your preferred rate and then wait for someone who is looking to transfer euros into pounds to agree to your rate and swap currencies. In order to ensure that the currency transfers are protected, all customers’ funds are held in CurrencyFair’s third-party bank account until a trade is agreed. If you’re looking for a quicker international transfer and don’t have the time to wait to find a trade, you can instead opt to sell your currency directly to CurrencyFair at their set rate. While this does not guarantee the most favourable transfer rate on the market, it does ensure quick and simple international transfers at a better-than-average exchange rate.

The Exchange Rate and Potential Savings

Traditional international bank transfers are notoriously unfair when it comes to currency conversion because they use an inflated exchange rate in their own favour and pocket the difference. As if this wasn’t enough, they also charge an average of a £25 fee for small transactions and take a large percentage of bigger exchanges.

So, what exactly is CurrencyFair’s exchange rate and how much does it cost to transfer currency? It really depends on whether you choose to set your own currency rate and wait for a trade or whether you sell your currency directly to CurrencyFair.

As an example, if you transferred £100 GBP into Australian dollars, you would receive $173.75 at an exchange rate of 1 GBP = 1.75 AUD. At the time of printing, the exchange rate displayed by Google was 1 GBP = 1.78 AUD, meaning that CurrencyFair offers a fair and accurate rate. The $4 flat fee CurrencyFair charges is deducted from the converted amount before the currency reaches the recipient bank account. In comparison to the average bank transfer, this means that the recipient will receive over $30 more for the transaction. CurrencyFair estimate that the average user can save 8x as much money using their service rather than their own banks.

One issue to be wary of when using CurrencyFair is the fees associated with transferring non-local currency. For example, if you were holding AUD in a British registered bank, you can expect to pay up to a £25 non-local currency charge. However, this fee is largely unavoidable as it is deducted by your banking institute and not by CurrencyFair. Currently, CurrencyFair receives USD, CAD, AED, ZAR, and NZD into non-local accounts.

Step-By-Step Guide

Transferring money with CurrencyFair is very straightforward. Firstly, you will need to make an account. If you are a business or a freelance worker, you can create a business account to manage your international payments and ensure that you get the best value for your goods and services. CurrencyFair was named the best online provider for sending international payments up to £10,000 to Europe in a Which report, owing to the speed and ease of transaction as well as the security of the service and the value for money. Note than in order to activate your account you will need to verify your identity using your passport or driving licence. This is done for the security of all users and is common practice when dealing with financial transactions.

Once you have an account set up, you simply transfer your selected amount into CurrencyFair’s secure client account. Once this is done, your CurrencyFair account will be credited with your funds and you’ll be notified by email.

Once your funds have reached your account, you can exchange your currency. If you aren’t fussed about a quick transferral and would prefer to hold out to get the most value for your money, you can set your desired rate and wait for another customer to agree to your offer. For a quicker exchange, simply select ‘Create an Auto-Transaction’ to exchange your money with CurrencyFair on their best rate.

Once your funds have been exchanged, enter the recipient bank details. This can be your own bank account or a third-party account, as long as you have access to the bank account’s details. Once you’ve arranged your transfer, sit back and let CurrencyFair take care of the rest. You can expect the funds to reach the recipient account in 1-5 working days.

Pros and Cons of CurrencyFair

There are pros and cons of CurrencyFair. The potential savings to be made are outstanding and are certainly a huge draw to the money-conscious. Better yet, because CurrencyFair charge a set fee of just a few $/£ instead of a percentage rate like most bank providers, the more money you transfer overseas, the more money you can save. On an international transfer of a few thousand GBP, the recipient can expect to see a saving of a few hundred AUD, more than making the service an essential for small-business owners and backpackers looking to transfer all of their savings in the most cost-effective way.

Another fantastic benefit of using CurrencyFair has to be the Facebook and Twitter support pages. Here wary users can get reassurance about the service as well as advice on making a transfer. CurrencyFair’s social media pages have advisors live and willing to help at all hours of the day so if you’re ever stuck, you can resolve an issue right away. This gives a little bit extra peace of mind when dealing with large international transactions. The CurrencyFair app – available on Apple and Android – is another convenient touch. It allows users to manage their funds and check the status of their exchange on the go.

Final Thoughts

Overall, CurrencyFair are offering a fantastic budget-friendly service. Due to the low service fee on large transactions, this service should definitely be on an international business owner’s radar if they want to maximise their profit margins. Likewise, backpackers just setting out on their trip would be wise to take advantage of CurrencyFair to make their money last longer on their travels.

[reviews_schema stars=”5″ name=”CurrencyFair”]